Not known Facts About Hard Money Atlanta

Wiki Article

Hard Money Atlanta - An Overview

Table of ContentsThe Single Strategy To Use For Hard Money Atlanta5 Simple Techniques For Hard Money AtlantaAbout Hard Money AtlantaHow Hard Money Atlanta can Save You Time, Stress, and Money.Top Guidelines Of Hard Money Atlanta

These tasks are normally completed rapidly, thus the demand for quick accessibility to funds. Make money from the task can be utilized as a deposit on the following, for that reason, tough money car loans permit financiers to range and turn more homes per time - hard money atlanta. Offered that the repairing to resale period is short (typically less than a year), residence fins do not require the long-lasting lendings that typical mortgage loan providers use.Typical lenders may be considered the antithesis of tough money lending institutions. What is a hard money lender?

Usually, these variables are not the most crucial consideration for funding credentials. Interest prices may also differ based on the loan provider and the bargain in question.

Hard cash loan providers would additionally charge a charge for supplying the finance, and these fees are likewise called "points." They usually finish up being anywhere from 1- 5% of the overall loan amount, however, factors would typically amount to one percentage factor of the finance. The major distinction between a difficult cash lender and various other lending institutions exists in the approval procedure.

Hard Money Atlanta Fundamentals Explained

A difficult cash lender, on the other hand, concentrates on the asset to be bought as the leading consideration. Credit history scores, income, and other individual needs come secondary. They also differ in terms of simplicity of accessibility to funding as well as interest rates; hard money loan providers supply moneying quickly as well as bill greater interest rates.You can find one in among the following means: A straightforward web search Request suggestions from local genuine estate representatives Request recommendations from real estate investors/ investor teams Because the lendings are non-conforming, you should take your time evaluating the needs and also terms offered before making a computed as well as informed decision.

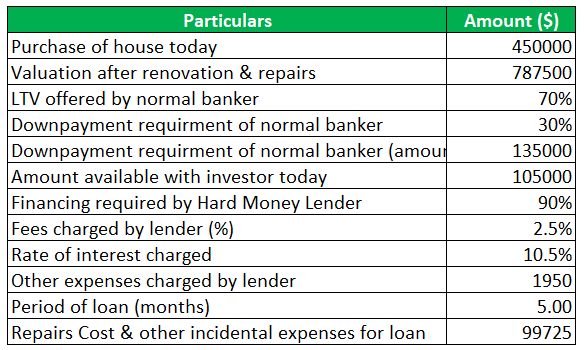

It is important to run the numbers before going with a tough money loan to make sure that you do not run right into any loss. Obtain your difficult money finance today and get a financing dedication in 1 day.

These loans can typically be acquired much more swiftly than a traditional car loan, and often without a huge down settlement. A difficult money financing is a collateral-backed funding, secured by the genuine estate being acquired. The size of the funding is identified by the estimated value of the property after recommended repair work are made.

What Does Hard Money Atlanta Mean?

The majority of difficult money financings have a term of 6 to twelve months, although in some circumstances, longer terms can be set up. The customer makes a month-to-month settlement to the loan provider, normally an interest-only settlement. Below's just how a regular difficult cash car loan functions: The debtor intends to buy a fixer-upper for $100,000.

Bear in mind that some lending institutions will certainly call for more cash in the deal, and request a minimum down repayment of 10-20%. It can be useful for the financier to choose the lending institutions that need very little down repayment options to lower their money to close. There will certainly also be the regular title fees related to shutting a deal.

Make certain to consult the difficult money loan provider to see if there are prepayment charges charged or a minimal return they need. Assuming you remain in the loan for 3 months, as well as the building costs the forecasted $180,000, the investor makes a revenue of $25,000. If the residential or commercial property costs even more than $180,000, the buyer makes more cash.

Due to the much shorter term and high rates of interest, there normally needs to be restoration as well as upside equity to catch, whether its a flip or rental property. A difficult money funding is ideal for a buyer who desires to deal with and turn an underestimated residential or commercial property within a reasonably short duration of time.

The Main Principles Of Hard Money Atlanta

It is essential to recognize how difficult cash finances work as well as just how they differ from standard finances. Banks as well as various other conventional monetary institutions stem most long-term fundings and also mortgages. These traditional lending institutions do not commonly deal in difficult cash loans. Instead, difficult money finances are released by private financiers, funds or brokers that inevitably source the offers from the exclusive capitalists or funds.

Facts About Hard Money Atlanta Revealed

When using for a hard money loan, debtors require to prove that they have sufficient resources to effectively get via a deal. (ARV) of the residential property that is, the approximated value of the home after all improvements have actually been made.Report this wiki page